by Shauna Millar

According to The Tax Policy Center “Rainy day funds, also known as budget stabilization funds, allow states to set aside surplus revenue for use during unexpected deficits. Every state has some type of rainy day fund, though deposit and withdrawal rules vary considerably.”

In 2018, Washington state’s rainy day fund (RDF) ranked #4 in the nation – having one of the highest balances. It was calculated that the state government could run for 51.7 days with these funds.

Warnings Were Given to Save, Instead of Spend, to Prepare for an Unexpected Economic Downturn

In 2018, both the state treasurer Duane Davidson and Deputy Treasurer Jason Richter, gave warnings;

“… We just don’t feel that is a sustainable approach to our long-term fiscal year to be running the end balance to nothing when times are relatively good.” Richter stated.

Davidson warned against raiding the rainy day funds in 2018 suggesting that it could come back to bite the state if there was an economic downturn. He said that the aim should be to get the fund to 10%.

“Our biggest concerns are our ability to handle an upcoming recession,” he said. “That’s the whole purpose of the budget stabilization account.”

Currently, Washington States RDF is 8% of the state expenditures. Washington State transfers 1% of the general state revenues for that fiscal year to the budget stabilization account (RDF).

The March 2020 policy brief by the Washington Research Council states:

With the supplemental, appropriations are 20.5 percent higher in 2019–21 than in 2017–19. Even in a booming economy, we would consider such a high increase to be unsustainable. With the economic outlook collapsing over the past few weeks, the spending increase looks remarkably unsustainable. It is almost certain that the budget is based on revenues that will not be collected.*

Who will pay the bills?

As we know, government doesn’t make money. The federal reserve prints currency which is NOT the same as making money. People make money and the government receives its money from the taxes that we pay. Taxes collected from companies as well as individuals are what fund our government.

They use the funds collected from these taxes to run the state, including state employee payroll (from the Governor down), state retirement plans, education, legislation, conservation, unemployment, welfare funding, as well as special projects. All these and more are paid for by the taxes that businesses, employees and individuals pay. With the rise of unemployment, the closures of business and companies moving out of the state, these funds are becoming more and more depleted.

According to the September 2020 Revenue Report, here are a few facts. (Read the Full Report Here.)

- In April the unemployment rate was at an all time high of 16.3% – the highest since 1976 .

- There is a 4.7% expected decline of Washington employment.

- There is an expected employment growth of 2.3% from 2021-2025.

- Forecasted Education Legacy Trust Account (ELTA) revenue for the 2019-21 biennium increased by $164 million, due to both higher real estate excise tax receipts and higher estate tax receipts

According to the November 2020 Revenue Report:

- Seattle-area consumer price inflation exceeded the national average in October.

- The October unemployment rate was at 8.3%

- Tax payments by businesses in the accommodation and food services sector were down 33.8% year over year. Last month

receipts from the sector were down 37.8% year over year. - Tax payments by businesses in the construction sector were down 3.6% year over year. Last month receipts from the construction sector were down 4.2% year over year.

- Most of the surplus once again came from real estate excise tax (REET) collections. (46.1% higher than forecast).

- Property tax collections came in 6.8% higher than forecast.

In the 2020 Debt Affordability Study, Davidson states the following:

“Over the past twenty years, Washington’s outstanding general obligation debt has increased from $7.3 billion to $19.3 billion. While these financings have funded a variety of important projects, our heavy reliance on bonds has left the State with a high debt burden.

“Washington has the 8th highest debt per capita in the country. Every Washingtonian would have to contribute $2,613 to fully repay the State’s debt, well over the national average of $1,068. [Ed. Note: According to the State of Washington Debt Clock, each man, woman and child would need to pay over $13,000 to cover the state debt.] In FY 2020, the State will pay more than $1.275 billion in debt service payments for its various purpose general obligation bonds, or 5.02% of total revenues.

“Washington enjoys a robust economy and strong revenue collections. This presents an opportunity to strengthen the State’s credit by emphasizing pay-go project financing, protecting our general fund and rainy day fund balances, and improving the funding status of our pension system. Now that the economy is strong, I urge the Legislature to ensure that the 2019-21 budget prepares the State to ride out the next economic downturn.”

– Duane A. Davidson, Washington State Treasurer

Where Will the Money Come From?

The Governor announced on November 15th, that there will be $50 million available to small businesses* from the CARES Act Aid to help get through his latest mandated shutdown. However, there is currently no date when these federal funds will become available for use. In the meantime, he stated he will be reaching out to the federal government for another fiscal helping hand; the state received $2.2 billion dollars in federal stimulus to help combat the fiscal drain that COVID brought. Yet, with the mandated closure of businesses, more companies (mostly small businesses, which historically employ about 80% of the workers) will be closing their doors. Seattle alone has seen 3,091 business shut their doors, of which 59% will never re-open.

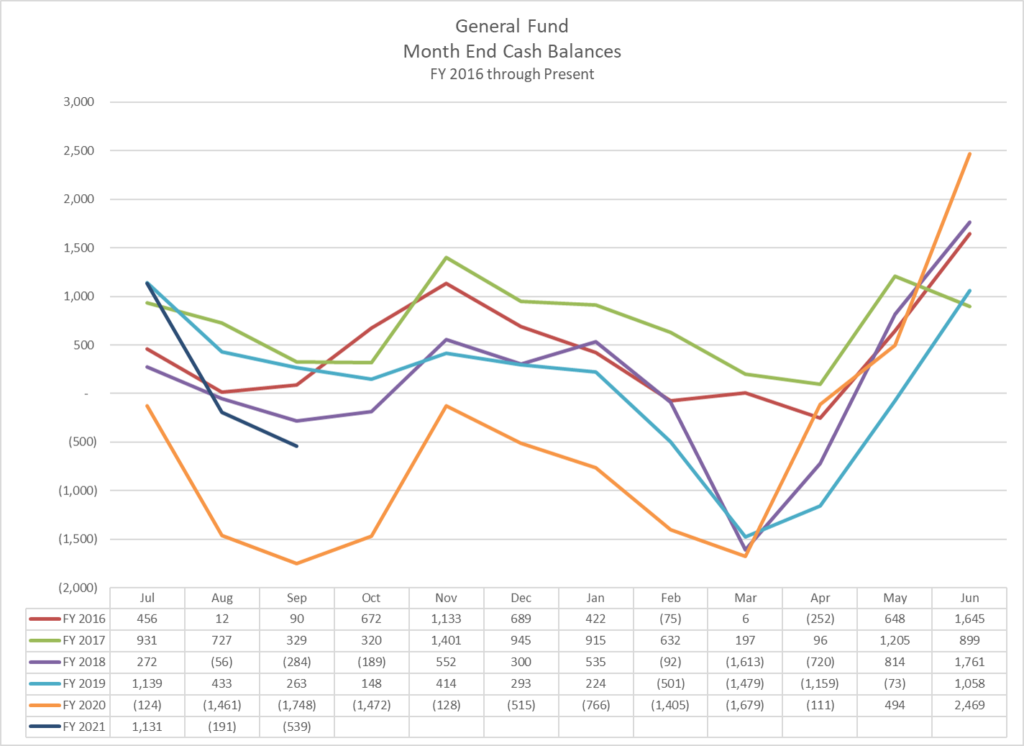

As of January 2021, the RDF is expected to have approximately $2.4 billion dollars which is offset by the expected $4.5 billion dollar deficit that has also been forecast; down from the originally forecast of $9 billion. According to research conducted by Standard and Poor’s (S&P), the main sources of revenue into Washington’s general fund are retail sales taxes (49%) and business and occupation taxes (18%). Both of these will see a decline into the general funds as businesses continue to close and/or have reduced sales.

It seems that real estate taxes and property tax will continue to help support the funding. The majority party has already been discussing the possibility of an increase in gas tax, a new, pay-per-mile tax which may also include a congestion tax and a state income tax, to be decided on in the next legislative session.

Rainy Day Fund Possibilities and Withdrawal Restrictions

According to the Washington State Constitution, Article VII, Section 12:

“(i) If the governor declares a state of emergency resulting from a catastrophic event that necessitates government action to protect life or public safety, then for that fiscal year moneys may be withdrawn and appropriated from the budget stabilization account, via separate legislation setting forth the nature of the emergency and containing an appropriation limited to the above authorized purposes as contained in the declaration, by a favorable vote of a majority of the members elected to each house of the legislature.”*

Early this year, while the legislature was still in session, a unanimous vote was passed to withdraw $100 million for the coronavirus efforts. This money was intended to help the people of Washington. Even though Republican legislators have since continuously called for a special session to further address the concerns of Washingtonians with the Governor’s refusal to call one, there is still currently no session in sight. (The legislature can do so with a 2/3 vote of the two bodies, but the Democrat majority thus far has not listened to the Republican minority every time they’ve been called upon to do so.)

It’s Past Time To Call a Special Session

By calling a special session, the legislature would be able to vote to use some of the rainy day funds to help the citizens of Washington State continue to get through these tough times. However, it seems that the Democrat majority would rather wait until the regular session in 2021 begins. While they received their pay raises, voted by the Washington Citizen’s Commission on Salaries for Elected Officials (WCCSEO) in 2019, went into effect this year. Governor Inslee managed to save the state $253 million by cancelling the scheduled 3% pay raise for approximately 5,600 state employees.

While some of these elected officials will be donating the difference in their paycheck this year to help various organizations throughout the state, there is still talk of “needing to raise taxes” – while businesses continue to shut down and more families end up on unemployment or homeless. A special session would help steer the state back in the right direction. The legislature needs to take a hard look at what cuts the state can make from the budget in order to bring the state debt down without raising taxes. In addition, they should offer incentives to small businesses to help them get back on their feet so communities can begin to thrive again.

Additional Resources:

- Washington Research Council, Policy Brief – March 30, 2020

- Opportunity Washington

- Budget Stabilization Account (Rainy Day Fund)

- Tax Policy Center

- Washington State Treasurer – Balance Reports

- The Lens

- 2018 Debt Affordability Study

- 2020 Debt Affordability Study

- Washington State Economic and Revenue Council

- Economic Revenue update November 2020

- Citizens Guide to SJR 8206, Budget Stabilization Account

- Budget stabilization account—Governance. RCW 43.79.495

- Washington State Constitution – Article VII, Section 12 (Page 72-74)

- Office of Financial Management Wage Adjustments and Salary Increases

- Thousands of Seattle Business Have Closed for Good

- Panic Buying, Businesses Shutter among looming Covid Restrictions

- Inslee announces additional COVID financial support

Recent Comments